social security tax limit 2021

The Social Security taxable maximum is 142800 in 2021. The Social Security tax limit in 2021 is 885360.

Social Security Benefit Calculation Spreadsheet Social Security Benefits Social Security Disability Social Security Disability Benefits

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax.

. Ad Compare Your 2022 Tax Bracket vs. Fifty percent of a taxpayers benefits may be taxable if they are. Workers pay a 62 Social Security tax on.

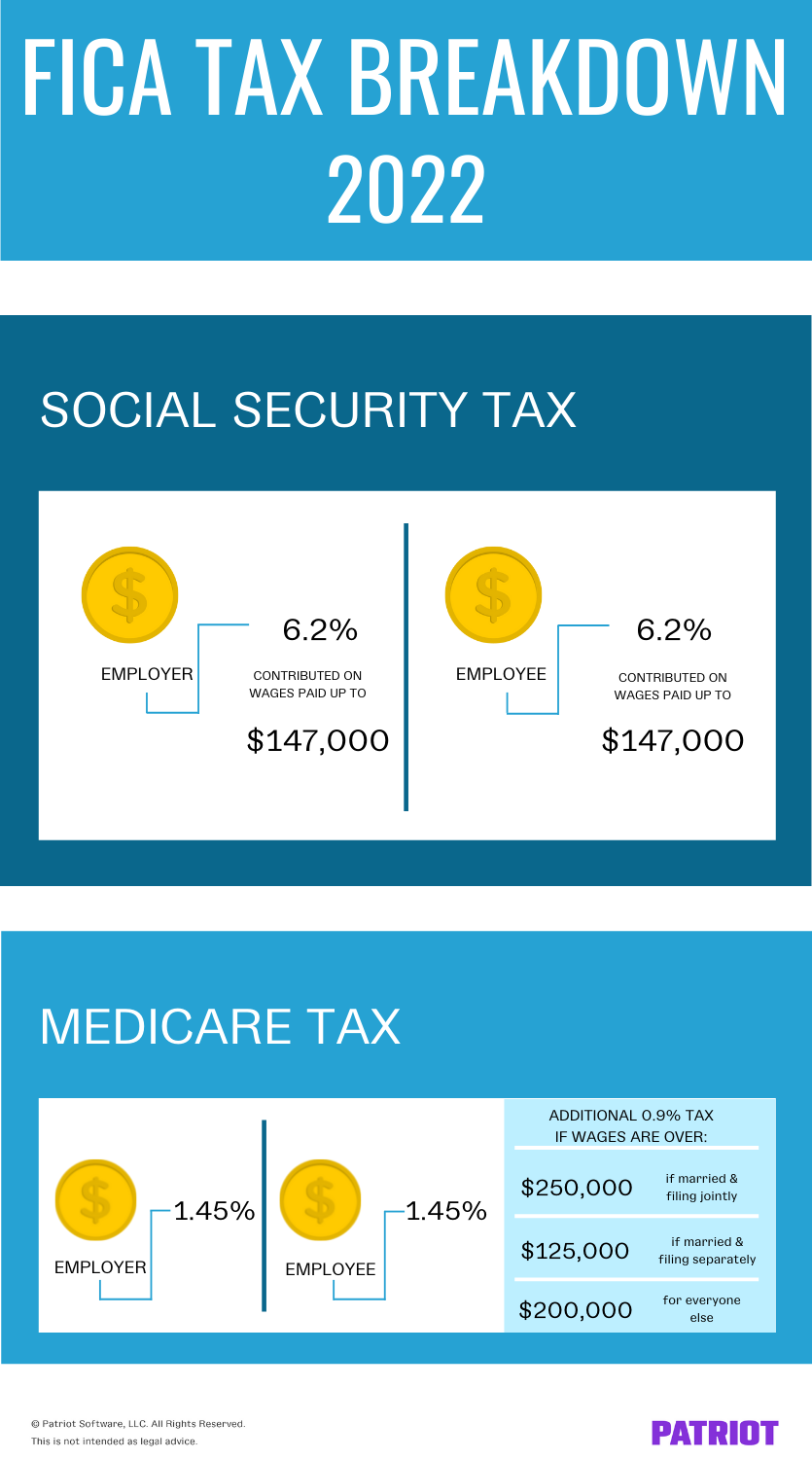

If that total is more than 32000 then part of their Social Security may be taxable. The maximum amount of earnings subject to Social Security tax will rise 29 to 147000 from 142800 in 2021. 125000 for married taxpayers filing a.

In addition your future benefit amount will not increase once your income surpasses the maximum taxable earnings limit. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Hospital Insurance HI also called Medicare Part ANo limit Federal Tax Rate.

Most people need 40 credits to qualify for retirement benefits. For earnings in 2022 this base is 147000. In 2022 the Social Security tax limit is 147000 up from 142800 in 2021.

Workers pay a 62 Social Security tax on their earnings until they reach 142800 in earnings for the year. Workers pay a 62 Social Security tax on. 1470 5880 for four.

2021 Social SecuritySSIMedicare Information Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings. Tax Rate 2020 2021 Employee. This means that you will not be required to pay any additional Social Security taxes beyond this amount.

The same annual limit also applies when those earnings are used in a benefit computation. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus 145 Medicare tax on the first 200000 of wages 250000 for joint returns. The total of one-half of the benefits and all other income is more than 34000 44000 for Married Filing Jointly.

Each year the federal government sets a limit on the amount of earnings subject to Social Security tax. Amounts for 1937-74 and for 1979-81. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages.

62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus. The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which you are applying. Amounts for 1937-74 and for 1979-81.

When you work you earn credits toward Social Security benefits. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security. Max OASDI Max HI Earnings Required for a Quarter of Coverage in 2021.

It was created for the social security program. Or Publication 51 for agricultural employers. Generally up to 50 of benefits will be taxable.

If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your Social Security benefits in 2021 according to the Social Security Administration. First the wage base news. If an employees 2021 wages salaries etc.

Filing single head of household or qualifying widow or widower with more than 34000 income. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security. You can earn a maximum of four credits each year.

The Social Security taxable maximum is 142800 in 2021. If you earn 142800. Calculating the Maximum Social Security Tax The official name of the social security tax is OASDI or Old-Age Survivors and Disability Insurance.

In 2021 the maximum social security tax is 142800. Employers Social Security Payroll Tax for 2022. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax.

Exceed 142800 the amount in excess of 142800 is not subject to the Social Security tax. Hence the maximum amount of the employers Social Security tax for each employee in 2021 is 885360 62 X 142800. Married filing separately and lived apart from their spouse for all of 2021 with more than 34000 income.

That means a bigger tax bill for about 12 million. Refer to Whats New in Publication 15 for the current wage limit for social security wages. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax.

Up to 85 of a taxpayers benefits may be taxable if they are. For 2021 an employee will pay. Your 2021 Tax Bracket to See Whats Been Adjusted.

The wage base limit is the maximum wage thats subject to the tax for that year. Discover Helpful Information and Resources on Taxes From AARP. The Social Security tax limit in 2021 is 885360.

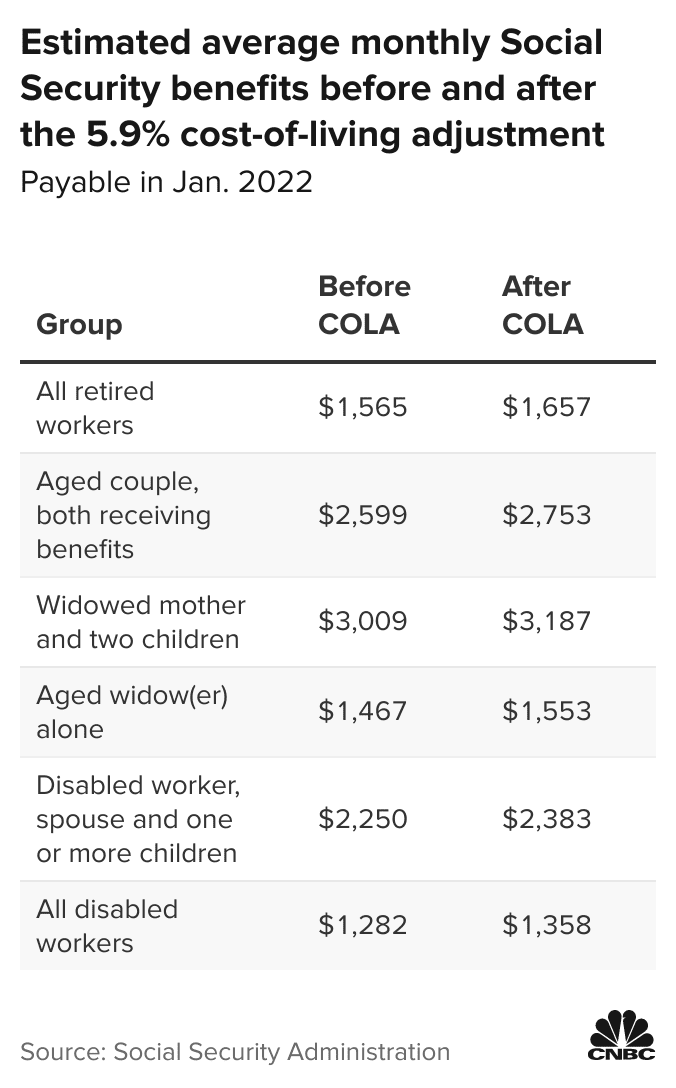

Any income earned above that amount is not subject to social security tax. Married filing jointly with more than 44000 income. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021.

Social Securitys Old-Age Survivors and Disability Insurance OASDI program limits the amount of earnings subject to taxation for a given year. However up to 85 of benefits can be taxable if either of the following situations applies. 9 rows This amount is known as the maximum taxable earnings and changes each year.

The Social Security taxable maximum is 142800 in 2021. Wage Base Limits. The rate consists of two parts.

Other important 2021 Social Security information is as follows. Only the social security tax has a wage base limit.

May 17 Tax Filing Deadline What Expats Need To Know In 2021 Filing Taxes Tax Deadline Tax Filing Deadline

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Is Social Security Tax Calculations Reporting More

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

The New Update May Catalyze Gifa Token Price Higher In 2021 Token Could Play Science Journal

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

2021 Social Security Earnings Limit Youtube Social Security Social Financial Decisions

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500 Dengi Finansy Delat Dengi

State By State Guide To Taxes On Retirees Retirement Income Income Tax Sales Tax

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

5 9 Social Security Cost Of Living Adjustment Takes Effect This Month

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Social Security Tax Cap In 2021 Staircase Lighting Paint Drop Staircase

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo